BLOG

THE SECURE ACT 2.0: What Plan Sponsors Need to Know

The SECURE 2.0 Act of 2022 seeks to increase retirement savings and expand coverage to employer sponsored retirement plans. New provisions such as mandatory automatic enrollment, higher catch-up contributions for older workers, and part-time worker 401(k) eligibility are intended to support higher plan participation, address longevity risks, and improve retirement readiness among Americans.

LEGISLATIVE UPDATE: CONSOLIDATED APPROPRIATIONS ACT OF 2023 (SECURE ACT 2.0)

We’ve compiled a breakdown of SECURE 2.0’s most impactful tax provisions to individual taxpayers

2023 TAX REFERENCE GUIDE

These tax tables are designed to offer a quick summary of tax brackets and taxes for: personal income, capital gains, children, and both employer and personal retirement plans.

Planning for a Market Downtown

Recent market volatility reminds us of the ever-present risks inherent in stock investing. When bear markets occur, many investors instinctively seek shelter on the sidelines. But, as history demonstrates, leaving the market—even temporarily—can be costly over the long-term. So, what can investors do now to manage current market volatility?

INVEST IN YOUR FUTURE THIS NATIONAL 401(K) DAY

Making regular contributions to a 401(k) plan provides a valuable way to save for your future—allowing assets to compound and grow tax-deferred. But keeping your long-term goals on track involves periodically reviewing and adjusting your strategy along the way.

Jay Adkisson

Wed. November 17 | 10am PT Asset protection is commonly used to mitigate the effects of future creditors, lawsuits, and other liabilities. Jay Adkisson, attorney and Managing Partner of Adkisson Pitet LLP, explores current planning trends and how life insurance can be an effective asset protection tool when used within trusts and advanced estate planning […]

Andy Friedman

Wed. November 11 | 10am PT Proposed changes to tax legislation could have significant market and economic impacts. In this special legislative session, Washington insider Andy Friedman discusses what proposed tax changes could mean for retirement investors and small business owners, and offer insights for year-end planning.

Ella Chase

Wed. September 29 | 10am PT Ella Chase, co-founder of Wellth Works and a sixth-generation inheritor within a family enterprise, uniquely understands the advisor-client relationship for HNW women. Ella will discuss tactical tools to improve advisor relationships with clients and their family members so that advisors can “stick with the family,” and she’ll address and […]

Tracy Brower

Wed. August 18 | 10am PT Join sociologist and author Dr. Tracy Brower for an engaging discussion about the future of work, leadership, and engagement and how to best motivate ourselves and employees. Dr. Brower will cover new research, surprising insights, and pragmatic approaches to cultivate and sustain resilience and success through the continuous changes […]

Wealth Transfer Under the Biden Tax Plan

This paper delves into the implications of a repeal of stepped-up basis, and sets out strategies advisors may consider to mitigate the effect of this potential change.

Andy Friedman

Wed. June 23 | 10am PT Andy Friedman is known for his unique insight and analysis of the political landscape and prospective legislation. He will share his views on proposed tax changes and what this could mean for all facets of the financial industry.

Paul Sullivan

Wed. April 15 | 10am PT Paul Sullivan writes the Wealth Matters column for The New York Times covering issues from private banking and wealth management to philanthropy and inheritance. His articles have appeared in publications such as Fortune, Money, and The Financial Times.

Ian Bremmer

Wed. March 18 | 10am PT Join renowned political scientist Ian Bremmer for a trip around the world in 20 minutes. Ian unpacks the geopolitical landscape and its impact on the U.S. economy, climate issues, cybersecurity, and more. He shares why we should feel optimistic about the post-pandemic recovery, as well as the principal global […]

Jonathan Godsall

Wed. February 24 | 10am PT Jonathan Godsall provides data-driven insights into how the insurance industry is adapting to meet the expectations of the client of the future. Watch the replay to hear more about the trends reshaping the industry, the changing needs of consumers, and the importance of expanded and enhanced digital capabilities.

Andy Friedman

Wed. February 17 | 10am PT Andy Friedman provides a comprehensive review of the new Washington landscape and its potential effects on taxes and investing.

Paulo Pinho

Wed. January 27 | 10:00 am PT Dr. Paulo Pinho looks at why COVID-19 has caused challenges finding coverage for jumbo cases and older clients. Dr. Pinho discusses co-morbid conditions and how they exacerbate COVID-19, how reinsurers view COVID-19, the keys to success for the vaccines, and what has to happen before things return to […]

Holiday Cocktails with a Twist

We’ve shared some of our favorite holiday recipes with you… now it’s time for our favorite cocktail recipes (with a couple of twists). Happy holidays to all of you and CHEERS to the end of 2020!

Kedra Newsom

Wed. October 28 | 10:00 am PT Kedra Newsom of Boston Consulting Group engaged the M Community in a robust discussion about women’s wealth and the complex needs of HNW and UHNW women. She shared specific strategies for advisors in this market and how the industry is changing to better reach this audience.

Paul Ryan

Wed. October 7 | 10:00 am PT M Financial was honored to welcome Paul Ryan, former Speaker of the U.S. House of Representatives, as our fall Future of Insurance keynote speaker. From his two decades in office to the founding of the nonprofit American Idea Foundation, Paul Ryan’s career has focused on public policy and […]

Carrier Discussion

Wed. September 23 | 10:00 am PT Henry Wong & Tod Nasser – John Hancock & Pacific Life Wondering how the current state of the economy and capital markets are impacting carrier portfolios and investments, and what that means for new business? Tod Nasser of Pacific Life and Henry Wong from John Hancock engaged in a panel discussion […]

Don Delf

Wed. September 9 | 10:00 am PT Don Delf, Private Wealth Advisory Leader for PwC US, brought his legacy and expertise in private wealth to answer the trillion-dollar question: What’s top of mind for business owners and family offices heading into elections and uncertainty? Don also explored how elasticity of exemptions is critical in the […]

Tony Arnerich

Wed. August 12 | 10:00 am PT Multi-Impact Asset Management in the Current Economy Tony Arnerich explored current trends related to ESG (environmental, social, governance) investing, intentional investing, and wealth transfer to the next generation. He demonstrated how the pandemic has created opportunities for environmentally and socially responsible investing and the implications to your clients’ […]

A Beautiful Smile

I let him know that while it was not inexpensive, it was fair and worth it and something we wanted to do. More importantly, it was something his Mom and I had been planning and saving for.

Scott Clemons

Wed. July 29 | 10:00 am PT Investing in the Wake of a Pandemic Scott Clemons, Chief Investment Strategist for Brown Brothers Harriman, examined the data around the pandemic’s effects on the economy. He also discussed the impact for insurance companies managing large amounts of money, what it means for your clients’ portfolios, and the […]

Zanny Beddoes

Wed. July 15 | 10:00 am PT Our Global Economy in the Post-Pandemic World KEYNOTE SPEAKER: Zanny Minton Beddoes – The Economist Named one of the Most Powerful Women in the World by Forbes, Zanny Minton Beddoes is a leading voice at the intersection of economics and policy. Known for delivering sophisticated insight on all facets of […]

Marc Cadin and Armstrong Robinson

Wed. June 24 | 12:30 PT COVID = Accelerant for Change AALU/GAMA’s Marc Cadin and Armstrong Robinson examined developing political trends and what financial professionals should expect through election day. They also explored the long-term impact of recent regulatory and legislative actions and identified the top opportunities and threats these regulations will generate for financial […]

Marc-Andre Giguere

Wed. June 17 | 11:00 am PT What do your HNW clients and key advisors need to know about how the reinsurance sector is responding to current What do your HNW clients and key advisors need to know about how the reinsurance sector is responding to current market conditions? Marc-Andre Giguere discussed possible ripple effects […]

Doug French

Wed. June 3 | 10:00 am PT Beyond COVID 19 – How the insurance industry will reimagine their business. Doug French, Ernst & Young’s Managing Principal of Insurance & Actuarial Services, examined the current economic disruption, its impact on the global insurance marketplace, and the effects on wealth transfer for the UHNW client, followed by […]

Colin Devine

Wed. June 3 | 10:00 am PT Outlook for the U.S. Life Insurance Industry After COVID-19 Colin Devine, Principal of C. Devine & Associates, examined the current status of the U.S. life insurance industry and how life insurers are doing amid COVID-19. Colin offers deep insights into what to expect in the coming months, the new […]

Dr. Quincy Krosby

Wed. May 6 | 10:00 am PT Of the Moment Market Outlook Dr. Quincy Krosby, Prudential’s Chief Market Strategist, discussed how the pandemic is impacting financial markets and the overall economy. Dr. Krosby explored the recent and rapid shift in consumer behavior and the emergence of new technologies for navigating the current landscape, and she […]

What the CARES Act Means for Retirement Plan Participants

The Coronavirus Aid, Relief, and Economic Security (CARES) Act offers about $2 trillion in funds to help the nation weather the pandemic. The portions of the law that are particularly relevant to individuals who participate in qualified retirement plans are highlighted in the document linked below.

Jeff Bush

Wed. April 22 | 9:30 am PT An Overview of the Political Environment, Prospective Legislation, and Strategies for Investment and Retirement Planning Jeff Bush and Andy Friedman have collaborated on a 2020 presentation that addresses all of the issues brought about by the recent coronavirus pandemic. In his April 22 presentation, Jeff explored the details […]

COVID-19 Financial Tips + Wellness Classes

In the days and weeks ahead, we will be providing content here that hopefully will help you cope financially with the COVID-19 virus. Some will be news updates, some will be planning suggestions, some may just be sayings and stories meant to educate and inform, while also putting a smile on your face…. but all are meant to help us as we navigate this new world. We are all in this together, and together we will get through it.

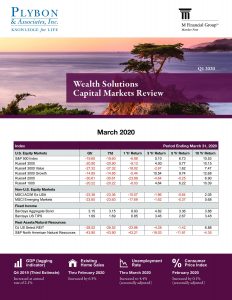

Capital Markets Review Q1

The U.S. equity market declined 20.9% in the first quarter, posting its worst quarterly performance since the 2008 Global Financial Crisis.

Message about COVID-19

Plybon & Associates is open, working regular office hours (and then some!), and is ready to assist you in any and every way. We are all healthy, as are our families, and hope you are as well.

401k and COVID-19: Dos and Don'ts

While it is easy to understand why some may be questioning their retirement plan choices, reactionary decisions to short term market conditions can lead to severe consequences down the road.

Planning for Tomorrow, Enjoying Today

Today I’m not thinking about the future so much. I’m remembering the past and embracing today, and reminding myself that all three – past, present and future – are important.